Attention: a new VAT system for EU deliveries since January 1st 2015

Since January 1st 2015, a change has come into force in the VAT system for deliveries within the EU. It will have a significant impact on you, if you supply telecom, broadcasting or electronic services to a private customer in another EU member state than the one in which you are established.

Since January 1st 2015, a change has come into force in the VAT system for deliveries within the EU. It will have a significant impact on you, if you supply telecom, broadcasting or electronic services to a private customer in another EU member state than the one in which you are established.

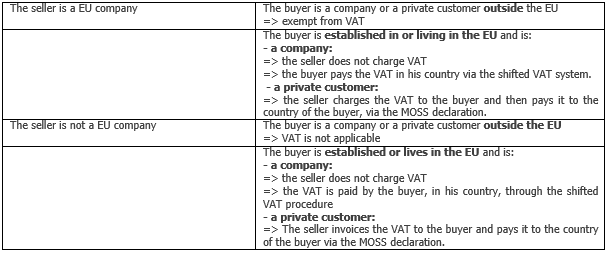

On the 1st of January 2015, a profound modification of the VAT rules applicable to sales in EU countries has come into force. The principle of B2B (business to business) will remain unchanged. Up till now, when a company in the EU sold something to another company with a EU VAT number, the VAT was shifted. In other words, the seller did not charge VAT, and the buyer had to include it in his monthly or quarterly VAT declaration. This rule remains into force.

There will, however, be changes for companies working in telecom, broadcasting or electronic services to private customers, like e-books, digital music, mobile applications, etc. Before, the VAT was collected in the country of the seller, whereas now the VAT will always be collected in the country of the buyer and one will have to use the rate applicable in the country of the buyer!

Here are a few rules of thumb with concrete examples.

Note: by “supplier”, we always mean a company that supplies telecom, broadcasting or electronic services like software downloads, cloud computing and content services.

- The supplier is established outside the EU and

- (B2B) he sells a product or service to a company in the EU: the seller does not need to charge VAT. The buyer has to include the VAT in his VAT declaration.

Concretely: an Australian company supplies telecom services to a company in the Netherlands. The Dutch company has to include the VAT in its VAT declaration.

- (B2C) he sells a product or service to a private customer in the EU: the seller has to charge the VAT and pay it to the country where the buyer is established. He has to apply the rates applied in the country of the buyer. Concretely: an Australian company supplies an e-book to a private customer in the Netherlands. The supplier has to charge VAT to the buyer and has to register with the VAT services in the Netherlands or any other member state via the MOSS (see further), after which he pays the collected VAT to MOSS after having filed a declaration.

Attention: the VAT rate is 21% - in the Netherlands, the reduced rate for books only applies to “paper” books – not to downloaded books!

- The supplier is established in the EU and

- (B2B) he sells a product or service to a company or user outside the EU: no VAT is owed. Concretely: A Hungarian company sells an antivirus program that can be downloaded from its website. The customer is a company or a private customer from Australia. The Hungarian company does not owe any VAT to Hungarian or other EU VAT services.

- (B2B) he sells a product or service to a company in the EU: the seller does not have to charge any VAT. The buyer has to pay the VAT in the country where he is established. Concretely: your company is established in Belgium and you sell an app to a Dutch company. In that case, you do not have to charge VAT like before the modification. The Dutch company has to pay the VAT through the deferred tax system with its monthly or quarterly VAT declaration.

- (B2C) he sells a product or service to a private customer in the EU: the seller charges the VAT, based on the percentage applicable in the country of the buyer. He pays that VAT through the MOSS service to the country where the buyer is established. Concretely: your company is established in Belgium and you sell software to a Dutch private customer. You charge the VAT based on the percentage used in the Netherlands, namely 21%. You pay this VAT via your MOSS declaration (see further).

Mini One Stop Shop (MOSS)

In order to make this modification possible in practice and to avoid that you need to register in every EU country, the Mini One Stop Shop (MOSS) was created. If you are a Belgian company, you can thus complete all the formalities for all the member states in one go. You do, however, have to register beforehand. After that, you have to submit an electronic declaration once every quarter, which mentions the VAT due per member state. You pay the sum for the VAT, after which the fiscal administrations will redistribute that VAT and transfer it to the involved member states.

For the Mini One Stop Shop, you could register as of the 1st of October 2014. Not registered yet? Do it quickly, because this VAT legislation will come into effect on the 1st of January 2015!

Recap

It is quite clear that from now on, you will have to apply the rates that are used in the country of the buyer – not in your own country. Remember that when you work with rates that include VAT! For most electronic goods and services, the standard rate applies. For Belgium and the Netherlands, that is 21%; you will apply 19% for Germany, 20% for France, 22% for Italy and 17% for Luxemburg.

Concretely, you can look up the different VAT rates for the member states in this document from the EU.