Starting a side job as a freelancer: what you need to know

Are you considering starting a side business as a freelancer? You're right; dreams are meant to be pursued. Do your research and find out if becoming a part-time self-employed person is right for you. Don't act rashly; understand everything involved, from accounting to creating your own website. This way, you'll undoubtedly get off to a flying start!

- Starting a side business: what does it mean?

- Starting a side business: the benefits

- Starting a side business: the paperwork

- Really starting to work as a self-employed person in a side business

- Coming up with a business name

- Create the perfect business name

- Hosting for your website or webshop

- Creating a website

- Starting a side business: promoting your business

- "I want to become self-employed in a side business"

- Frequently asked questions about starting as a self-employed person in a side business

Starting a side business: what does it mean?

Becoming self-employed in a side job is a step many Belgians have taken, according to recent figures. You're not alone in considering this idea, and the number of entrepreneurs starting side businesses is on the rise.

To clarify, starting a side business means having a primary job with an employer while also conducting an independent activity. It's common for employees to want to turn their passion into part of their profession.

For example, Julie works part-time as a job coach at a temp agency. That's her main job. Additionally, she is a cat groomer who pays visits at home, which is her side business as a freelancer.

Becoming self-employed in a side job comes with conditions

Not everyone can simply start as a self-employed person in a side job. There are clear conditions attached to this. Many websites provide information on this topic, and we base our information on what the Flemish government states.

You can become self-employed in a side job if you:

There are different conditions for those working in education and through temporary contracts.

Starting a side business: the benefits

Having a hobby or passion that you want to pursue professionally can greatly enrich your life. Starting as a self-employed person in a side job provides the right framework for this.

But in addition, there are several other benefits that come with starting up independently in a secondary occupation. HR services provider Securex lists some of them. How about these:

However, not everything is as rosy. Starting a side business requires certain sacrifices, such as the time you will need to invest. Be fully aware of this.

Additionally, in some cases, you will have to pay social contributions without gaining extra social rights in return. Since your extra income is on top of your salary as an employee, you may end up paying more taxes.

Starting a side business also means you will need to make significant initial investments. Hiring an accountant is advisable.

To keep things organized, it's best to invest in good invoicing and accounting software. Starting your side business with enthusiasm gives you a lot of energy, but don't underestimate the importance of good administration. This is essential to keep your head cool and stay afloat!

Starting a side business: the paperwork

If you want to start a side business as a freelancer, you'll need to handle the necessary administration. Call it a paperwork marathon. However, these formalities are essential to ensure you comply with regulations and do everything by the book. 😉

Here's what you need to do:

- Register as a self-employed person in a side business at the Crossroads Bank for Enterprises (CBE). This cannot be done directly, but through an accredited business office.

- Apply for and activate a VAT number, even if you are exempt from VAT obligations.

- Join a social insurance fund.

- Apply for any necessary permits, depending on your side business.

- Take out mandatory and additional insurances.

- Open a (business) bank account.

- Collaborate with an excellent accountant or accounting firm.

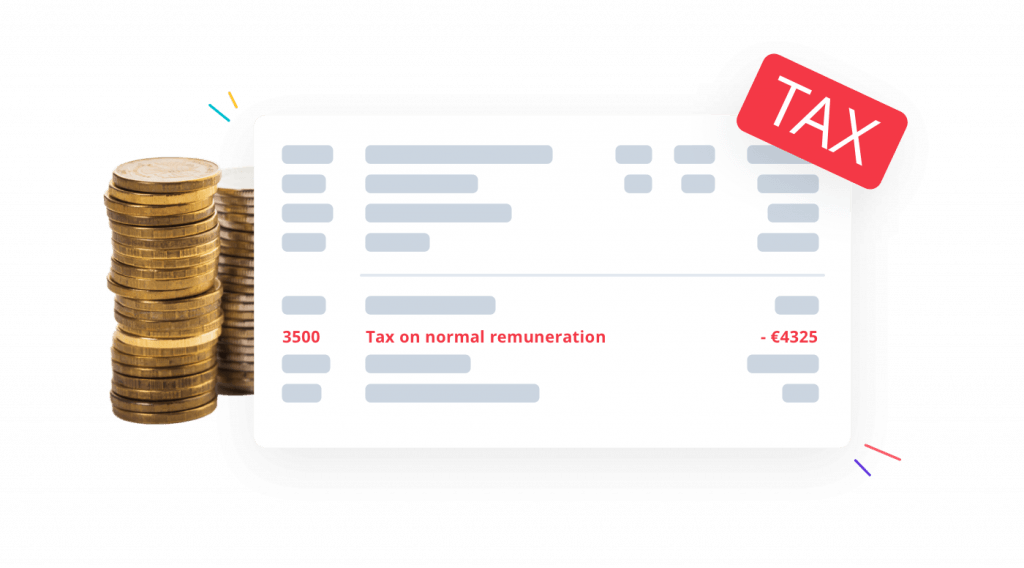

Taxes, social contributions, and VAT

Starting a side business is all well and good, but what about taxes, social contributions, and VAT? You are probably wondering which rules apply to you and what your obligations are.

Paying taxes

Starting a side business means you perform two activities: as an employee in your primary job and as a self-employed person in your side business. Both activities generate professional income, which is your net taxable income.

You must pay taxes on this taxable income. Since your two incomes are combined, you might move into a higher tax bracket. This depends on your total income.

On the other hand, certain business expenses are tax-deductible. As the saying goes, "keep the receipts." The difference between your profit and your business expenses determines the income on which you must pay taxes.

Examples of tax-deductible business expenses include an internet subscription, accountant fees, office supplies, etc. Expenses such as restaurant visits or your car are partially deductible.

Don't forget: if your annual turnover exceeds 25,000 euros, you are required to submit a customer listing to the tax authorities.

Paying Social Contributions

Starting a sole proprietorship as a side business also means you must pay social contributions on your income. This is a so-called solidarity contribution, as you do not receive extra social rights in return.

Self-employed persons in a side business usually do not build up social rights unless they pay at least the minimum contribution of a full-time self-employed person. This can provide additional pension rights and certain benefits, such as free service vouchers.

If your self-employed activity is limited, meaning you earn a fairly low income from your side business, you can get an exemption and do not have to pay social contributions.

Paying VAT

Are you liable for VAT when starting your own side business? There is sometimes confusion about this.

The rules are actually quite simple: if the turnover from your side business does not exceed 25,000 euros excluding VAT, and your self-employed activity does not involve performing work on real estate, you do not have to pay VAT.

As a logical consequence, you cannot deduct VAT or purchase products without VAT. However, if you do have to pay VAT, you can regularly file VAT returns and deduct VAT on your purchases.

Really starting to work as a self-employed person in a side business

Got your administration in order and clicking with your accountant? Now it’s time to truly start as a self-employed person in a side business.

We assume you’ve carefully considered this big step, that you know why you want to become self-employed in a side business, and how you’re going to approach it. Whatever you choose, whichever path you take, chances are very high that you’ll go online with your business.

Coming up with a business name

From the beginning, you need to consider the online aspect of your business. This starts even with choosing a business name because the domain name might already be taken. You don’t want a website with a different name than your own business.

With your own domain name, you can easily start an online shop as a side business. So, choose a good business name. The associated domain name is your online address where customers can find you. Fortunately, this isn’t the biggest expense, but don’t just go for the cheapest option.

Register your domain name with a reliable hosting company. With Combell, for instance, you get numerous benefits and free extras!

Create the perfect business name

Want to become self-employed in a side business but don’t have the perfect business name yet? Try our handy business name generator, designed to create unique names.

Simply describe what your business does, choose the language for your business name, and experiment with style and type. Then, AI will generate business names that align with your preferences. It’s as simple as that!

This way, you start your business with the right, memorable name. You’ll receive 10 unique suggestions. Like one of them? Check immediately if the corresponding domain name is still available.

Hosting for your website or webshop

To succeed as a self-employed person in a side business, you definitely need a website. But before you can start, you need hosting. Hosting is your virtual plot of land where you set up your website.

Without hosting, you can’t start a webshop. Will it cost you a lot of money? That can vary.

Compare different hosting providers and the packages they offer. There are very cheap providers, but will you get value for your money? Choose only a package that fits the size and needs of your business.

With Combell, you get reliable advice. This way, you won’t end up with unnecessary high-tech features. As a beginner, you can go a long way with a decent and professional basic package.

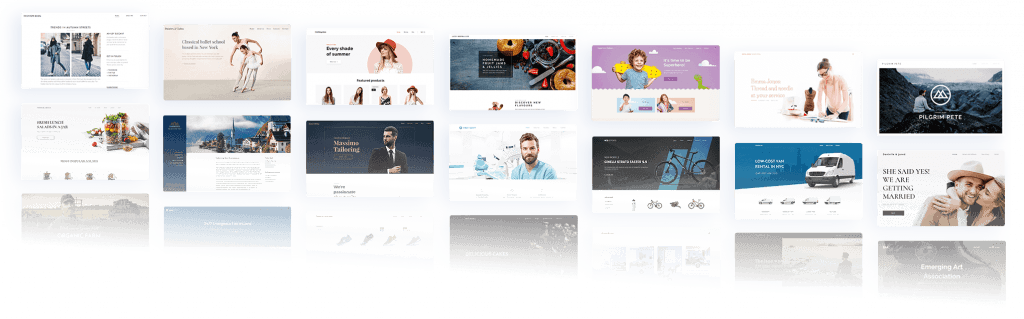

Creating a website

Before you can fully launch your side business, it’s time to give your website or webshop a sleek look. This means ensuring a beautiful web design and building your website.

You have two options: have your website made by a web agency, for example, or roll up your sleeves and do it yourself. While starting a side business requires investments and costs, the price tag of a custom-made website can be too high. As a beginner, you often have a limited budget.

Before partnering with anyone, it’s very important to know what your budget can handle and what you can expect from the professional website builder. The software you use, the size of your webshop, various plugins, and other factors will determine the total bill.

Cut costs

Prefer to design that sleek look yourself? We at Combell recommend tools like SiteBuilder (with included hosting) and WordPress. These platforms are specially designed for those who want to create their own website. You have full control and can keep costs down.

SiteBuilder is your savior if you’re a complete beginner, while WordPress requires a bit more technical knowledge. "SiteBuilder is affordable and more than worth the investment", says our client Vanessa, who runs a restaurant independently.

Tip

Both SiteBuilder and WordPress come with an AI webshop builder. This means you don’t have to build your site or shop yourself; Artificial Intelligence does it for you! Try it now.

Starting a side business: promoting your business

In addition to establishing an online presence, there's much more involved in starting as a self-employed person in a side business. You might need to give your premises a fresh coat of paint, purchase the right products, and determine the appropriate stock levels. You'll certainly have plenty to do. 🙂

We would like to add that it is very important to do promo for your own business. Potential customers need to get to know you. In what ways you can determine your target group, read our article on starting your own webshop.

Either way, social media and online marketing are the way to go. Create accounts on channels such as Instagram and Facebook. There, you can advertise your side business for free or in a fairly inexpensive way.

Tip

Link your website to Google My Business, which is your free business profile on Google. This helps attract customers to your business. You can provide extensive information about your business, add photos, and immediately show that your business has a website.

Choose a professional email address

By registering your domain name with Combell, you enjoy free extras! We offer you a professional email address with a mailbox. Choosing a professional email address helps you appear professional and gain the trust of your customers.

With your professional email address, you can start email marketing. Our email marketing tool, Flexmail, makes it easy (and free) to stay in touch with your visitors through newsletters and your own promotional emails.

"I want to become self-employed in a side business"

Did you just think that while reading this article? Great! We wish you the best of luck with your startup. Take it step by step, carefully consider the choices you make, and get good guidance!

For the online part of your side business, you can count on the entire Combell team. See you soon?